A reverse mortgage loan is simply another type of mortgage…with a couple of great features. The best one?

You don’t have to make monthly payments!

You can pay any amount, any time, if you choose, with no penalty but…the choice is yours.

Like with any mortgage, the home remains in your name.

Qualifications are less stringent than for conventional mortgages. You need sufficient income to pay annual property taxes, homeowners insurance and contractual monthly loan obligations and/or credit card payments, unless you choose to eliminate those debts with loan proceeds. In addition, income, based on family size, is needed to cover maintenance and living expenses.

There are numerous options available as to how to receive money from your reverse mortgage loan including monthly payments from the lender and/or a line of credit with the available amount increasing yearly!

Retirement may last a long time and it’s important for seniors to understand viable options to help ensure that retirement finances remain sound. A reverse mortgage loan might be an important tool in that regard.

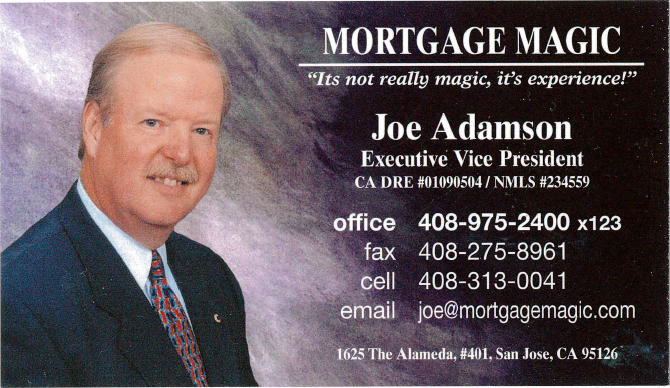

For information or questions, please contact me per the info noted on my card above. I’m happy to help however I may.