Despite numerous regulatory changes, new disclosure requirements, and lending restrictions, the same basic loan qualification factors still apply. Does a potential borrower earn enough to be able to make payments on all their monthly obligations? Have they shown consistent willingness to do so as evidenced by their credit history and if, for whatever reason, they become unable or unwilling to make required payments, can the borrower provide sufficient collateral to protect the lender? If the answer to each of these questions is yes, approval will be granted.

Lenders refer to the qualification criteria as the “three C’s)…Credit, Capacity and Collateral. If a borrower has sufficient, satisfactory credit, a low enough ratio of monthly payments to monthly income and has sufficient collateral to protect the lender against failure to make payments, they will qualify.

Credit doesn’t have to be perfect, top-tier income is not required for most loans, and, for mortgages, limited equity often is acceptable. If credit history is reasonable, a pattern of responsible credit usage is demonstrated, especially with longer term reliable income sources, and the home is in marketable condition, then approval is likely even with limited equity and less than upper income.

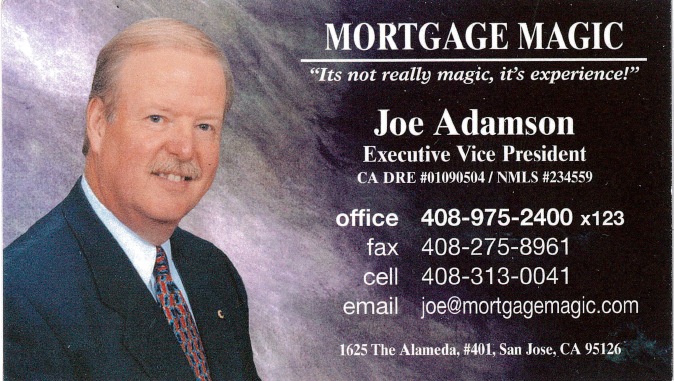

I’ve helped a great many clients navigate the requirements to a successful transaction and I’d be happy to help you do the same.