Business regulations, including extensive ones governing financial services and lending industries, would be unnecessary if all business people operated honestly.

One of the regulations in RESPA (Real Estate Settlement and Procedures Act) addresses “kickbacks”. It’s illegal to pay commissions, referral fees, etc., to any non-licensed person for the referral of mortgage loans. Simply stated, loan agents cannot share their or their company’s income from a loan transaction. There are rare exceptions…too rare to mention here.

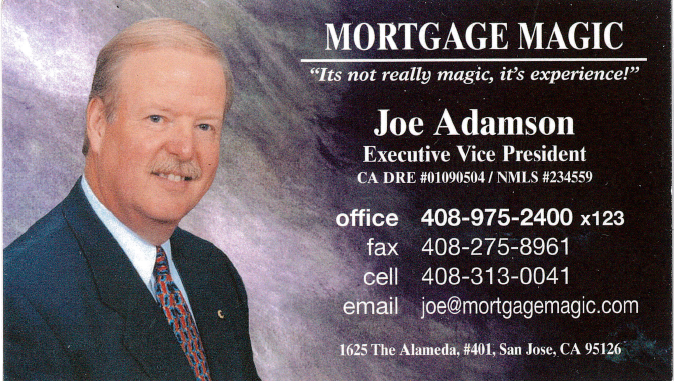

This a very basic rule governing compensation for lending activity and I cannot imagine any licensed mortgage broker not being fully aware of it. Still, this week one of our agents called to say that a local real estate broker, known for a substantial purchase volume, wanted to meet to discuss referring clients to us for pre-qualification leading to a mortgage loan. Of course, we were interested in meeting. That is, until our agent relayed the broker’s question of how much we would pay for such referrals.

If allowed by their state, a real estate agent can gift all or part of their commission to a buyer or seller. Lending, however, is federally regulated and no portion of earnings paid to a mortgage broker for a mortgage loan can be paid to anyone other than the licensed loan agent employed by the broker who arranged the loan. The illegal payment of such fees can have a negative impact on both buyers and sellers in such transactions and we won’t work with anyone who ignores that or any other applicable regulation.