There’s no question that high home prices in Silicon Valley makes it difficult for first-time home buyers to purchase homes. Difficult…but not necessarily impossible. Recently (past year), qualification requirements have eased somewhat for many higher balance programs including the minimum … Read the rest

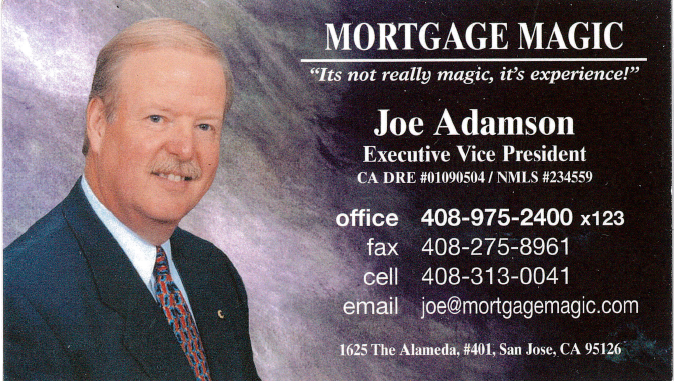

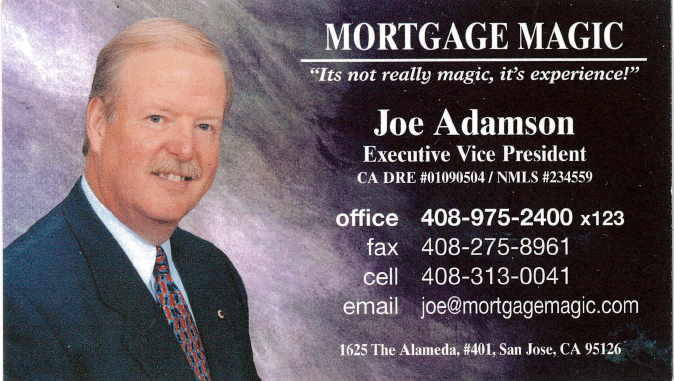

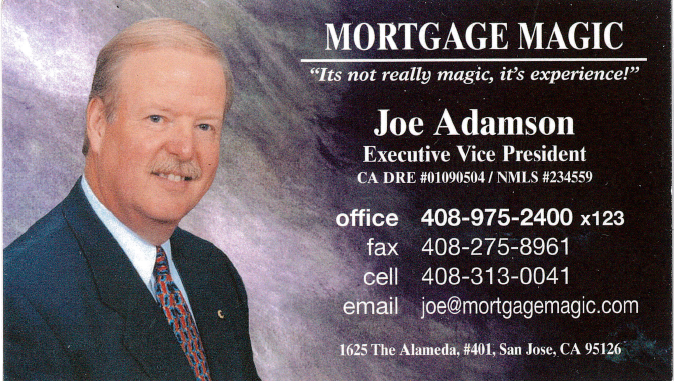

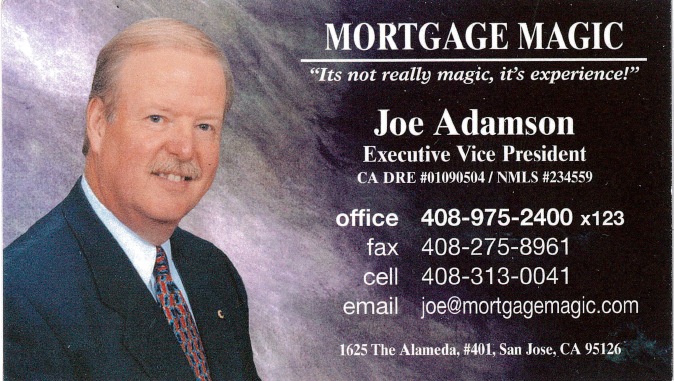

Help For Home Buyers